|

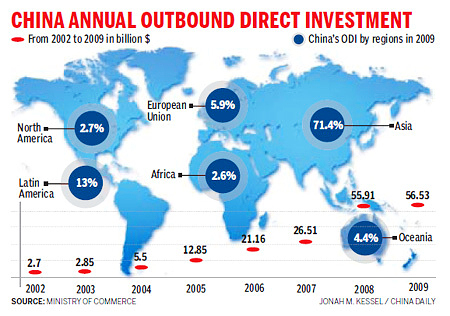

| A world map of China's ODI distribution (Photo/China Daily) |

A World Map

By the end of 2011, Chinese investors had poured money into 177 countries and regions, covering 72 percent of the world's total, according to official statistics. 70 percent of China's ODI flowed into Asian countries. Developing countries attracted 89 percent of China's ODI, and developed countries received the remaining 11 percent, the data showed.

Mei Xinyu, a researcher at the Chinese Academy of International Trade and Economic Cooperation, believes that such investment structure was attributed to the comparatively low market access requirements and low production costs in developing countries.

"Developed countries have stringent market access restrictions, while Chinese investment is more welcome in developing countries," Mei said. "Plus, Chinese companies tend to invest in developing countries because of the low production costs there, and many of them remain incapable of operating in developed countries."

Although China's overseas investment was mostly concentrated in developing countries, that in the developed countries has been on the rise at a rather fast pace.

By the end of last year, China's ODI in Europe had rapidly increased for three consecutive years and covered all 27 member states of the European Union.

Chinese investment in the United States rose nearly 39 percent year-on-year in 2011 and increased by almost 30 percent during the first seven months of this year.

"With China's growing overall economic strength and the ever-increasing competitiveness of Chinese companies, China's overseas investment will gradually switch to developed countries," Ms. Shi said. "This trend has become increasingly evident in recent years."

According to statistics from China's Ministry of Commerce, China's ODI in the European Union (EU) surged 280 percent year-on-year in 2009 and more than doubled to reach $6 billion in 2010. In 2011, China's ODI in Europe rose 22.1 percent year-on-year to $8.3 billion.

Rhodium Group, a New York-based consultancy that analyzes global trends, said in a report issued in September that China's annual investment in Europe tripled from 2006 to 2009, and tripled again in 2011. The number of deals with a value of more than $1 million doubled from less than 50 in 2010 to almost 100 in 2011.

According to a report from accounting firm PricewaterhouseCoopers in France, in 2011, the amount of Chinese investment in Europe for the first time exceeded the amount of investment by European companies in China.

By the end of 2011, China's cumulative investment in the United Kingdom reached $2.3 billion. "Half of that was made in 2011 alone," said Wu Kegang, Chief China Adviser of the British Chambers of Commerce.

Chinese investment in the United States also surged. According to a recent report issued by the Asia Society and Rhodium Group, China has set the stage for a record year for outbound investment to the United States with Chinese firms completing investment transactions worth $6.3 billion in the first three quarters of this year.

"China is an increasingly important source of FDI," said Brenda Foster, president of AmCham Shanghai. "It is critical to educate U.S. states on what can be done to attract more investment from China."

Residential building collapses in E China's Ningbo

Residential building collapses in E China's Ningbo

![]()