On the one hand, the emerging economies are undergoing rapid development, so they have attracted a large amount of international capital; on the other hand, the structural problems in the U.S. economy itself represent a serious barrier deterring foreign capital from entering the American market.

Over the years, the U.S. has been the most favored market for international capital, leading the world in its share of overseas investment. But the international capital inflow has shrunk rapidly in recent years, to the concern of all American business sectors.

For more than ten years, overseas investments in the U.S. have followed this downward trend. Data show the U.S. captured 37 percent of the world's total foreign investment in 2000, but the figure had declined to 17 percent by 2012; in the first half of this year only 6.6 billion U.S. dollars of investment flowed into the country, representing a 22 percent drop compared to the same period in 2012 (8.4 billion U.S. dollars.)

The trend is puzzling: Why is foreign capital still stagnating this year while the U.S. economy is showing obvious positive signs in 2013? The author believes that the reduction in overseas investment is not a short-term phenomenon, and that profound structural factors in the economy and politics are at play.

First, the evolution of investment patterns, caused by the rapid growth in emerging markets, is a principal reason for the decline in U.S. foreign capital. When the world entered the new century, the GDP growth rate of the western countries encountered a sharp slowdown, ultimately resulting in the global financial crisis. At the same time the emerging economies, including China, were undergoing rapid growth and therefore attracting a higher share of international capital.

Second, major changes were taking place in America's economic structure, which were not conducive to attracting foreign investment. Ever since World War II, fundamental weaknesses have been apparent in the American economic model, featuring high spending and high debt. More recently, a variety of so called “low-risk, high yield" financial products, including submarine mortgage loans created by U.S. financial institutions on Wall Street, have loaded the U.S. government and the public with a heavy debt burden, and at the same time created a huge bubble within the U.S. economy. In the current circumstances, the ability to stimulate the economy through increased lending is very limited. Thus it is structural problems in the U.S. economy that are deterring the injection of international capital.

Also of significance, political maneuvering between different interest groups has posed another risk to foreign money. For example, the recent government shutdown and the accompanying threat of debt default delivered a heavy blow to the confidence of overseas money.

Furthermore, many potential concerns over U.S. policies and measures hinder the flow of foreign funds into the U.S. market.

Recently, the U.S. Department of Commerce convened a meeting in Washington and more than 1,200 government officials and executives from 60 countries gathered to discuss how to attract greater foreign investment. President Obama delivered a speech at the meeting in which he required the Department of State and the commerce department to make attracting overseas funds and promoting exports one of its top priorities; U.S. ambassadors were also asked to work to increase foreign investment in the U.S. economy.

Undoubtedly, a steadily growing U.S. economy is conductive to the sustainable and balanced development of the international economy. Although there is a trend towards diversified investment, the U.S. can still resolve its structural problems, including modifying discriminatory measures and polices targeting foreign investment, to help its market to regain its attraction for foreign capital.

Fire guts 22-storey Nigeria commercial building in Lagos

Fire guts 22-storey Nigeria commercial building in Lagos U.S. Navy Carrier Strike Group stages military exercises

U.S. Navy Carrier Strike Group stages military exercises Volkswagen showcases new energy vehicles in Beijing

Volkswagen showcases new energy vehicles in Beijing  A girl takes care of paralyzed father for 10 years

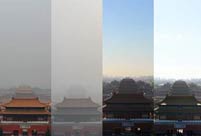

A girl takes care of paralyzed father for 10 years A record of Beijing air quality change

A record of Beijing air quality change In pictures: explosions occur in Taiyuan

In pictures: explosions occur in Taiyuan Hello! Horror Halloween Celebration!

Hello! Horror Halloween Celebration!  The catwalk to the world of fashion

The catwalk to the world of fashion  Cruise trip to Taiwan

Cruise trip to Taiwan  Unveil PLA air force base

Unveil PLA air force base  Loyal dog waits for master for six months

Loyal dog waits for master for six months Oriental education or western education?

Oriental education or western education? China in autumn: Kingdom of red and golden

China in autumn: Kingdom of red and golden National Geographic Traveler Photo Contest

National Geographic Traveler Photo Contest Chinese screen goddesses from Beijing Film Academy

Chinese screen goddesses from Beijing Film Academy Day|Week|Month