BEIJING, Nov. 8 -- Five years after China launched its own Cyber Monday - in the U.S., the Monday after Thanksgiving, promoted as an online shopping day - the lines have blurred between online retail platforms and bricks-and-mortar stores.

The erosion of the role of malls and local stores has incurred the wrath of dyed-in-the-wool retailers, and in the run-up to the annual online shopping spree on Nov. 11, major e-commerce players have dealt a fresh blow to traditional retailers by allowing consumers to try out their products before placing orders online.

While online retailers extend the shopping experience beyond the cyberspace and back into physical stores, yet more transactions will be made over the Internet, as better deals draw customers away from malls and department stores.

"E-commerce means stiffer competition in the retail sector, and retailers know the rush to the web is unstoppable," said Lu Renbo, deputy secretary general of China's Electronic Chamber of Commerce

E-competition is shifting from a simplistic price war to optimizing the shopping experience, according to Liu Qiangdong, founder and CEO of Jingdong, the nation's second largest online retailer.

Despite the e-commerce forays into their territory, traditional stores are ambivalent in the face of teetering sales.

Reaction to the switch to online from offline, known as the O2O business model, are mixed among retailers, who either open 'branches' in online marketplaces or simply brood over declining sales.

"E-commerce is upending traditional thinking, management and business models," said Sun Weimin, deputy chairman of Sunning, originally a home appliance chainstore, recently morphed into an O2O retailer.

Sunning expanded its product range and unified prices on and off the net. The company announced on Wednesday plans to close some of its 1,600 stores and revamp the remainder to support the online shopping experience and coordinate with logistics.

"At the end of the day, there is no distinction between online and offline: All stores will become a part of online retailing," said Wang Jian, chief techie at Alibaba, whose business-to-consumer marketplace TMall.com and consumer-to-consumer website Taobao.com claims the lion's share of China's online retail sales.

But not everyone is up for the change. As Singles Day approaches, a total of 19 home furnishing retailers have rallied against TMall, which has talked more than 30,000 traditional retailers into opening shops on its online bazaar while displaying their wares in their "offline" stores.

"When it comes to innovation in retail, it's a lot easier to just pay lip service, but who's ready to do so at the expense of their own interest?" said Shao Xiaofeng, chief risk officer at Alibaba.

Attempts by Xinhua to canvass the opinions of Macaline and Easyhome, two of China's largest home furnishing retailers, and leaders of the outcry against TMall's O2O model, fell on deaf ears.

"When companies are trying to use a boycott to reverse a trend, it means they are already losing relevance in an industry reshuffling its deck," said Alibaba's Wang.

LOGISTICS BOTTLENECK

Singles Day has transcended its original function as a day of celebration for the great unloved. It became a day of crazy online shopping when Alibaba launched its first sales campaign on that day in 2009.

Since then, sales at TMall on Singles Day have snowballed from 50 million yuan (8.2 million U.S. dollars) in 2009 to 19.1 billion last year, and are poised to top 30 billion this year. Nothing comes free and blossoming sales bring burgeoning problems: The Singles Day sales spike has called into question the ability to get the goods to the buyer's door.

More than 72 million parcels went out last year and couriers were overwhelmed. It's all very well for Alibaba's founder Jack Ma to brag about a 260 percent rise in sales,but he was soon deluged with embarrassing snaps of inadequate distribution centers overbrimming with parcels.

Alibaba admits that last year, less than half the parcels they sent to the Chinese mainland were delivered within three days. Some orders arrived weeks, or even months, later.

Adversity breeds invention and so Jack Ma formed a new venture in June with retailer Intime, conglomerate the Fosun Group and a host of couriers, to ride the wave of rising demand for delivery services.

The venture, Cainiao, which means "rookie" in Chinese, is absorbing as much as 100 billion yuan in investment to shore up an underdeveloped logistic network in China.

Progress will be tested on Singles Day, as Alibaba draws on data collected over years to analyze and forecast the flow of goods. This will help couriers make decisions on where to dispatch extra hands to handle sudden surges in cargo.

LARGEST ONLINE RETAIL MARKET

As online retailers and conventional stores square off in the world's largest Internet community (a netizen population of 564 million at the end of last year), online retail sales have risen steeply, reaching 1.3 trillion yuan in 2012, accounting for 6.3 percent of the retail market and likely to expand to 7.4 percent this year, according to China e-Business Research Center. This compares with 5 percent logged for the United States in the same period

A study by the McKinsey consultancy found that 60 percent of China's online consumption represents a switch from offline, while the remaining 40 percent is new demand that would otherwise be nonexistent without online stores. The Internet has either unearthed or bred consumption that lain dormant or been hidden. All this spending is exactly what is required to propel the economy through consumption rather than through export and investment.

With an estimated 296 billion U.S. dollars in online retail sales, China will soon surpass the United States as the world's largest online retail market.

"Integrating online and offline retail is not a change of Alibaba's marketing strategy, but rather a change in era." Alibaba's Wang said.

Fire guts 22-storey Nigeria commercial building in Lagos

Fire guts 22-storey Nigeria commercial building in Lagos U.S. Navy Carrier Strike Group stages military exercises

U.S. Navy Carrier Strike Group stages military exercises Volkswagen showcases new energy vehicles in Beijing

Volkswagen showcases new energy vehicles in Beijing  A girl takes care of paralyzed father for 10 years

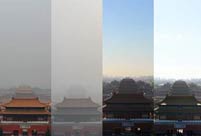

A girl takes care of paralyzed father for 10 years A record of Beijing air quality change

A record of Beijing air quality change In pictures: explosions occur in Taiyuan

In pictures: explosions occur in Taiyuan Hello! Horror Halloween Celebration!

Hello! Horror Halloween Celebration!  The catwalk to the world of fashion

The catwalk to the world of fashion  Cruise trip to Taiwan

Cruise trip to Taiwan  Unveil PLA air force base

Unveil PLA air force base  Loyal dog waits for master for six months

Loyal dog waits for master for six months Oriental education or western education?

Oriental education or western education? China in autumn: Kingdom of red and golden

China in autumn: Kingdom of red and golden National Geographic Traveler Photo Contest

National Geographic Traveler Photo Contest Chinese screen goddesses from Beijing Film Academy

Chinese screen goddesses from Beijing Film Academy Day|Week|Month