BEIJING, Dec. 20 -- "If the banks won't change, we will make them change," said charismatic e-billionaire Jack Ma as he led his young troops armed with Big Data to challenge the state-backed dinosaurs.

Having revolutionized China's shopping habits, Ma's Internet giant Alibaba is now making forays into the finance industry that he believes holds vast potential, with so many customers under-served and unhappy.

In June this year, Alipay, the online payment arm of Alibaba, launched "Yu'E Bao (Leftover Treasure)" a service that gives Alipay's millions of users the option of directly channeling spare money in their accounts into high interest funds.

With a minimum threshold at just one yuan (most wealth management products by banks demand at least 50,000 yuan) and returns far above bank deposit rates, Yu'E Bao was an instant hit, especially among young people whose driblet savings are largely ignored by banks.

Just five months later, the number of "Leftover Treasure Seekers" was nearly 30 million, with their deposits amounting to 100 billion yuan.

The success has meant more Internet bees buzzing around the honeypot. In October, China's leading search engine Baidu announced its first online wealth management product "Baifa".

Other cyber-finance products are blooming across the country. Peer-to-Peer (P2P) lending, the practice of private individuals lending and borrowing money through websites, has grown fast and threaten to grab a share of traditional banks' hefty profits.

In a policy report released in August, the People's Bank of China, China's central bank, made its first acknowledgment of booming Internet finance saying the services are filling an innovation gap left by traditional financial institutions, and should be encouraged.

Globally, the encounter between the Internet and finance has seldom been as dramatic as that which is unfolding in China. In countries such as the United States, market-sensitive financial institutions quickly adapted to new technologies and trends, leaving little room for Internet firms to make inroads.

But in China, where bloated banks are pampered by generous state support, inefficiencies have offered the perfect opportunities for Internet firms such as Alibaba to stage "China-style creative destruction", forcing fusty old institutions to evolve or perish.

"In recent years, Internet finance has marched into the core businesses of traditional banks, bringing us a strong sense of crisis," acknowledged Wang Yingjun, a strategy and development analyst with China Merchants Bank.

Internet finance may look Lilliputian in face of the Gulliver of China's powerful banks, but the real threat is that Internet firms, with their vast data banks on purchase habits and credit records, are better placed in the age of "Big Data".

When you combine that with China's tempered growth and relaxation of the government's grip on interest rates -- a major source of bank revenue -- you can already picture the challenges for big bank to secure the current profits.

Among China's 16 listed banks, the majority reported slower profit growth in the first three quarters. Those profits will shrink further if the dinosaurs are unwilling or unable to evolve, as China uses the free market to shore up growth.

Earlier this month, the central bank allowed interbank trading of deposit certificates, another step towards fully floating interest rates, following scrapping of the floor on lending rates in July.

The key reform decisions last month gave the green light to allowing private capital to set up banks, albeit modest ones. These reforms are a leg up for Internet finance which will lead to a more transparent, efficient and modern financial system, analysts said.

"To rise to the challenge, banks need a more diversified, customer-centered approach. They must restructure and make better use of the Internet to cut costs and improve transparency," said Wang from the Merchants Bank.

Although a worthy competitor to traditional banks, Internet finance, which is still minuscule in comparison, may eventually serve more as an alert for banks not to rest on their laurels and help move towards a more efficient market.

"From a long-term perspective, the Internet and traditional finance are not mutually exclusive. Integration of the two is the way forward," said Professor Dai Xianfeng with Renmin University of China.

As Jack Ma has put it, "we are not here to stop the show, but to build the future together."

People prepare for upcoming 'Chunyun'

People prepare for upcoming 'Chunyun'  Highlights of Beijing int'l luxury show

Highlights of Beijing int'l luxury show Record of Chinese expressions in 2013

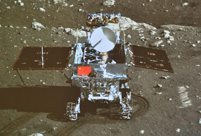

Record of Chinese expressions in 2013 China's moon rover, lander photograph each other

China's moon rover, lander photograph each other 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start Spring City Kunming witnesses snowfall

Spring City Kunming witnesses snowfall Heritage of Jinghu, arts of strings

Heritage of Jinghu, arts of strings Weekly Sports Photos

Weekly Sports Photos PLA elite units unveiled

PLA elite units unveiled  PLA elite units unveiled

PLA elite units unveiled  Chinese scientific expedition team

Chinese scientific expedition team  Heritage of Jinghu, arts of strings

Heritage of Jinghu, arts of strings The unchanged flavor of changing Beijing

The unchanged flavor of changing Beijing Miss Philippines crowned Miss International

Miss Philippines crowned Miss International Bolt throws down bus challenge in China

Bolt throws down bus challenge in ChinaDay|Week|Month