'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

BEIJING, Dec. 28 -- China yesterday unveiled a new set of guidelines aimed at strengthening the protection of small investors, the latest move to restore faith in the country’s sagging equity market.

The country will set up an insurance system to counter the risk of delisting of a listed firm and expand the size and use of an investor protection fund, the State Council, China’s Cabinet, said on its website.

The government will also improve the investor eligibility system in which investors will be classified based on their tolerance of risk and knowledge of the capital market in order to keep unqualified investors out of certain areas.

“Small and medium investors are the main participants of China’s capital market but they are weak in self-protection with a disadvantaged position of obtaining information,” the State Council said. “Protecting the interests of small investors is a foundation for the development of the capital markets.”

Chinese investors have long been disappointed by the country’s sluggish stock market, which has been among the world’s worst performers.

The Shanghai Composite Index still hovers around the same level it did in 2000 despite China’s GDP having more than quadrupled in the same period. Retail investors, who contribute around 80 percent of China stock market turnover, are also badly affected by rampant irregularities such as market manipulation, insider trading and falsified disclosures.

“The measures embody fairness and justice and are helpful to strengthen market confidence and stimulate market vitality,” Deng Ge, spokesman for the China Securities Regulatory Commission, said yesterday.

The guideline also promises to improve voting rights for small investors, including encouraging the use of online voting and urging listed companies to count the votes of small investors separately on issues that affect their interests.

Listed companies should disclose detailed plans of dividend payments and companies failing to deliver on their promise to distribute dividends will be banned from issuing additional shares, according to the guidelines.

The government will also encourage listed companies to buy back shares when their price falls below net asset values. Shareholders responsible for irregularities should compensate small investors with their own equities and assets, the guideline says.

China’s securities regulator has introduced a number of measures to bolster investor confidence, including tightening supervision on information disclosures and cracking down on fraud and insider trading.

Its initial public offering market is set to resume next month after a 13-month halt, the eighth IPO suspension since the stock market was established in a bid to boost listing transparency and support share prices.

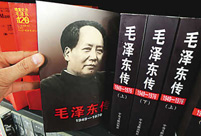

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture SWAT conducts anti-terror raid drill

SWAT conducts anti-terror raid drill AK-47 inventor dies at 94

AK-47 inventor dies at 94 Mother practices Taiji with her son

Mother practices Taiji with her son  Crashed French helicopter salvaged

Crashed French helicopter salvaged Winter travels in Anhui

Winter travels in Anhui  Bird show opens to public in Calcutta, India

Bird show opens to public in Calcutta, IndiaDay|Week|Month