'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

|

| People shop gold accessories in a gold store in Nanchang, capital of east China's Jiangxi Province, Dec. 26, 2013. Many people purchase gold products as price of gold continues to drop recently. (Xinhua/Zhou Mi) |

BEIJING, Dec. 31-- Gold prices are down this year, breaking a 13 year winning streak in China.

But instead of worrying Chinese consumers, lower prices mean they’re buying more of the yellow metal as the country has already become the world's largest for gold trade.

An increasing number of Chinese are purchasing gold with a passion. Gold counters are now as crowded as supermarkets in many of the cities.

Whatever commodity analysts say, in consumers’ eyes, the precious metal hasn’t lost its shine.

"Many consumers came to choose gold rings, bracelets and earrings for Christmas and New Year. Some are buying gifts while others are buying in bulk for investment," said Cai Xiaolin, a sales assistant at Laomiao Gold In Yuyuan Garden, one of the largest gold jewelry hubs in Shanghai.

The new wave of gold buying came amid a quick slump in the price of the precious metal at the year end.

Gold prices have plunged some 30 percent over the past 12 months, the fourth largest fall in one year since the 1970s in China.

On Friday, the average price of pure gold at Chow Sang Sang Jewellery store in Beijing was 294 yuan per gram, excluding processing charges.

In a neighboring store of Cai Bai the average price was down to 302 yuan per gram, almost 20 percent lower than the beginning of the year.

"During this period last year the price was at around 400 yuan per gram. This year it fell to around 200 yuan per gram. This has piqued consumers’ interest. We are seeing a rise in sales this year," said a salesperson.

Unlike the gold craze in April when China's consumers purchased 300 metric tons within two weeks after the price slumped, this time the hot sales are mainly driven by holiday consumption.

Most of them are still sitting tight while facing the definitely bad news of slump.

Zhang Ting, a 47-year-old Shanghai resident, said she purchased 200 grams of gold bars at 345 yuan per gram early this year, but she does not regard the investment as a failure.

"As long as I don't sell them at a lower price, I'm not losing money," said Zhang.

"In China, an interesting feature of the gold market is you can hardly tell investment in gold apart from gold consumption. Buyers can swiftly shift their holdings from one category to another," said Cao Xiaorui, director of jewelry, Far East, for the World Gold Council.

And moreover, China's gold market is marching at its own pace, added Cao.

"Investing in gold bars and coins is considered long-term, and an increasing number of investors are realizing that gold is ideal to hedge risks, and put 5 to 10 percent of their assets into gold," agreed Yang Fei, a Shanghai-based gold product analyst.

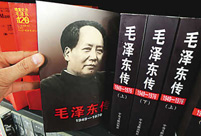

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture Yearender: Animals' life in 2013

Yearender: Animals' life in 2013 Hello 2014 - Chinese greet the New Year

Hello 2014 - Chinese greet the New Year Chocolate 'Terracotta Warriors' appear

Chocolate 'Terracotta Warriors' appear  Top 10 domestic news of 2013

Top 10 domestic news of 2013 Red crabs begin annual migrations in Australia

Red crabs begin annual migrations in Australia Artifacts retrieved from West Zhou Dynasty

Artifacts retrieved from West Zhou DynastyDay|Week|Month