Armed Police hold anti-terrorism drill in SE China's Xiamen

Armed Police hold anti-terrorism drill in SE China's Xiamen Harbin Int'l Ice and Snow Festival opens

Harbin Int'l Ice and Snow Festival opens 'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

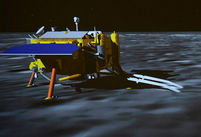

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each otherBEIJING, Jan. 8 -- Though latest figures indicate China's economy might have lost some steam into the close of 2013, most economists are optimistic over the country's growth momentum in 2014, with consensus that the economy will expand by about 7.5 percent.

They have also warned against risks related to industrial overcapacity, shadow banking and shadow credit expansion, local government debt, high interbank lending rates and financial liberalization.

The next 12 months will be "a year with hopes and challenges" for China, according to a report by a research team with the Bank of America Merrill Lynch led by chief China economist Lu Ting.

"In 2014, inflation will be slightly higher but remain tamed at 3.1 percent, and growth could be more stable on improved macro management of Beijing, albeit down slightly to 7.6 percent," Lu said in the report.

"We don't expect a hard landing in growth, a systematic financial crisis or nationwide debt crisis," he added.

Lu predicted that several themes will dominate the Chinese economy and its financial markets in 2014 -- a more confident leadership, bottom-up interest rate liberalization to bring revolutionary changes, a cleanup of mounting local government and corporate debts, and China being affected by a robust growth rebound in the United States as well as the Federal Reserve's QE tapering.

The Bank of America Merrill Lynch report forecast that China's GDP growth might moderate from 7.7 percent in 2013 to 7.6 percent in 2014. Sequential quarter-on-quarter GDP growth could be in a small range of 1.8 percent to 2.0 percent in the whole of 2014.

"Our 7.6-percent growth forecast for 2014 is right in the middle of a wide spectrum of Street forecasts," according to the report.

For optimists, or "bulls," who predict growth of above 8.0 percent, they believe the recovering U.S. and European economies will greatly quicken China's exports. Meanwhile, those "bears" who expect below 7.0-percent growth believe reforms such as reducing local government debt, cutting overcapacities and curbing shadow banking will significantly slow growth, Lu said.

He explained, "We are not as bullish on China's external demand as we expect a strong Renminbi, rising labor costs, and weak emerging markets will continue to weigh on China's exports.

"We are not as bearish because we believe shadow banking is not that scary, and deleveraging of local governments will be gently balanced by leveraging up the central government and restarting IPOs."

HSBC chief China economist Qu Hongbin was also relatively optimistic over China's growth prospects, projecting a 7.4-percent growth for the world's second-largest economy in 2014.

"We see a bigger upside than downside risk in our 2014 forecast," he said in a report.

The risks to the forecast may tilt to the upside, if external demand turns out to be better than expected and property investments remain strong due to softer-than-expected measures to cool the real estate market, he said.

Qu believes that the Chinese economy could expand by above 7.5 percent for the first half of 2014, before some moderation in the second half of the year, reflecting the impact of the base effect.

Although slower restocking activity may pose some downside risks in the near term, Qu maintained that China's growth will be supported by such factors as improving external demand, strong infrastructure investment, resilient consumer spending, and reform dividends.

According to the senior economist, 2014 in China will be a year of reform, covering areas ranging from taxation and land markets to financial liberalization and service sector deregulation.

This should fuel growth by unleashing the power of private investment and consumption, offsetting the short-term pain experienced during the early stages of reform, he said.

To mitigate risks, Qu urged China to curb shadow lending while regulating local government borrowing, rather than tightening overall credit conditions for the real economy.

Wang Tao, chief China economist at UBS, projected China's GDP growth in 2014 at 7.8 percent, slightly higher than in 2013.

"We only expect a modest slowdown in domestic investment, which should be more than offset by stronger export and domestic consumption growth," she wrote in a research note.

Wang, however, said there are three questions about China's macro policy and outlook in 2014 and significant unease over them in the market. These three big issues are excess credit growth, local government debt, and liquidity squeezes and rate spikes in the interbank market.

She maintained that China will pursue a slightly more prudent monetary policy and will better regulate the shadow credit market in 2014, slowing the pace of leverage but refraining from outright deleverage.

Local government debt will be put on a more sustainable and transparent path but will continue to grow. Periodic liquidity squeezes and rate spikes will likely persist but the negative impact on overall growth should be limited, Wang added.

Alaistair Chan, an economist with Moody's Analytics, said China's economy enters 2014 with solid momentum, low inflation, and rising household incomes.

Chan expects China's economy to expand by 7.5 percent in 2014 and make modest progress toward rebalancing.

However, China faces a range of problems this year, such as a housing market at risk of forming bubbles, high local government debt, increasing pollution, and overcapacity in many industrial sectors, Chan warned.

Chinese Consulate General in S.F. burned for arson attack

Chinese Consulate General in S.F. burned for arson attack Roar of J-15 fighter is melody for operator on the Liaoning

Roar of J-15 fighter is melody for operator on the Liaoning A 90-year-old forester's four decades

A 90-year-old forester's four decades Most touching moments in 2013

Most touching moments in 2013 2013: Joys and sorrows of world politicians

2013: Joys and sorrows of world politicians Missile destroyer Zhengzhou commissioned to Chinese navy

Missile destroyer Zhengzhou commissioned to Chinese navy China is technically ready to explore Mars

China is technically ready to explore Mars Photo story: Life changed by mobile technology

Photo story: Life changed by mobile technology Bullet train attendants' Christmas Eve

Bullet train attendants' Christmas Eve Heart-warming Laba porridge

Heart-warming Laba porridge Gallery: China's trapped icebreaker makes successful escape

Gallery: China's trapped icebreaker makes successful escape Photo story: We are special soldiers

Photo story: We are special soldiers Exploring the 'Maritime Silk Road'

Exploring the 'Maritime Silk Road' Armed Police hold anti-terrorism drill in SE China's Xiamen

Armed Police hold anti-terrorism drill in SE China's Xiamen Beautiful churches around the world

Beautiful churches around the worldDay|Week|Month