'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

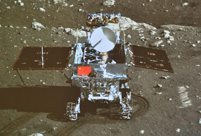

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

NEW YORK, Dec. 23 -- U.S. stocks rallied on Monday, with the Dow Jones Industrial Average and the S&P 500 extending their record runs, buoyed by decent economic data and a rise in Apple's shares.

The Dow increased 73.47 points, or 0.45 percent, to 16,294.61. The S&P 500 gained 9.67 points, or 0.53 percent, to 1,827.99. The Nasdaq Composite Index soared 44.16 points, or 1.08 percent, to 4, 148.90.

The main stock indices kicked off a shortened holiday week on a strong note. The U.S. stock market will end early at 1:00 p.m. local time on Tuesday and close on Wednesday for Christmas.

The equity market was boosted by a pair of positive consumer data, which strengthened the view that the world's largest economy is running at a faster pace. U.S. personal consumption expenditures increased 0.5 percent in November, the biggest gain in five months, while personal income edged up 0.2 percent, the Commerce Department said on Monday.

It was the seventh straight monthly increases for consumer spending, which matched economists' forecast.

Moreover, the U.S. consumer sentiment index jumped to a five- month high of 82.5 in December, higher than the November reading of 75.1, according to a Thomson Reuters/University of Michigan survey.

Besides, the Chicago Fed National Activity Index, a monthly index designed to gauge overall economic activity and related inflationary pressure, stood at 0.60 in November, up from minus 0. 07 in the preceding month. A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth, and positive values indicate above-average growth.

The tech-heavy Nasdaq outperformed the other two indices, underpinned by Apple, whose shares jumped 3.84 percent to 570.09 U. S. dollars apiece after the tech giant announced late Sunday that it had entered into a multi-year agreement with China Mobile to place iPhone into the world's largest mobile network. China Mobile will start to sell iPhone 5s and iPhone 5c across the Chinese mainland as of Jan. 17.

Facebook shares rose 4.81 percent to 57.77 dollars a share on Monday after the social-networking site's first day of trading as a member of the S&P 500 companies.

Among sectors, technology and telecom lead the gains of the S&P 500's 10 sectors, while consumer staples and utilities are the only two sectors that dipped.

Last week, Wall Street posted strong weekly gains, with the Dow and the S&P 500 sailing into uncharted territory, as Wall Street cheered the U.S. Federal Reserve's prudential tapering of its asset purchases and an upward revision of the U.S. economic growth in the third quarter.

On other markets, the U.S. dollar traded lower against most major currencies on Monday amid light trading ahead of Christmas, as many investors trimmed long dollar positions or locked gains from previous sessions before the end of the year.

In late New York trading, the euro rose to 1.3692 dollars from 1.3671 dollars in the previous session. The Australian dollar climbed to 0.8935 dollar from 0.8919 dollar.

Oil prices dropped on profit-taking after making considerable gains last week. Light, sweet crude for February delivery lost 41 cents to settle at 98.91 dollars a barrel on the New York Mercantile Exchange, while Brent crude for February delivery moved down 21 cents to close at 111.56 dollars a barrel.

Gold futures on the COMEX division of the New York Mercantile Exchange fell below 1,200 dollars per ounce on upbeat economic data. The most active gold contract for February delivery fell 6.7 dollars, or 0.56 percent, to settle at 1,197 dollars per ounce.

People prepare for upcoming 'Chunyun'

People prepare for upcoming 'Chunyun'  Highlights of Beijing int'l luxury show

Highlights of Beijing int'l luxury show Record of Chinese expressions in 2013

Record of Chinese expressions in 2013 China's moon rover, lander photograph each other

China's moon rover, lander photograph each other 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start Spring City Kunming witnesses snowfall

Spring City Kunming witnesses snowfall Heritage of Jinghu, arts of strings

Heritage of Jinghu, arts of strings Weekly Sports Photos

Weekly Sports Photos PLA elite units unveiled

PLA elite units unveiled  China's stealth fighters hold drill over plateau

China's stealth fighters hold drill over plateau Chinese navy hospital ship's mission

Chinese navy hospital ship's mission  "Free lunch" program initiated in NW China

"Free lunch" program initiated in NW China  Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan DPRK's Kaesong Industrial Complex

DPRK's Kaesong Industrial Complex 'Jin' named the word of the year

'Jin' named the word of the year Day|Week|Month