'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

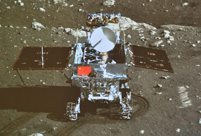

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

Which is the most discussed currency in this year? No arguments – the answer is the bitcoin.

Bitcoin is a digital cryptocurrency and essentially a code. It is decentralized and operates using a peer-to-peer network. The process of obtaining new bitcoins using computer power to solve a cryptographic algorithm is known as bitcoin mining.

In theory anyone can become a bitcoin miner, but it’s not easy to do so in reality. After studying how the bitcoin works, Lin Jia, a student at Beijing University of Posts and Telecommunications, takes the view that it is very difficult for ordinary people to start mining at home.

“Bitcoin mining is an expensive game, requiring specialized hardware and knowledge to solve mathematical puzzles. A home computer does not have the firepower to support the bitcoin mining operation,” says Lin.

There are various ways of acquiring bitcoins. One of the easiest and most common is to buy them with cash. The bitcoin has been recognized and granted legitimacy as legal tender in some countries and some Chinese companies have declared that they will accept bitcoin payment.

But the bitcoin’s prospects took a nosedive after China’s central bank issued an announcement early this month stating that the bitcoin has no legal status or monetary equivalent, and should not be used as currency. Financial institutions and payment systems are not allowed to handle bitcoin business.

But bitcoin deals continue among Chinese investors. OKCoin, a bitcoin trading platform, saw 66,225 bitcoins worth 300 million yuan (about 49.4 million U.S. dollars) being traded in the space of 24 hours on Dec. 16.

What is the fascination with the bitcoin? Many believe that their limited supply can secure the value of their fortune. Investments in bitcoins have indeed proved lucrative. In the first four months of this year, the value of the bitcoin increased tenfold, leading to a great number of speculators seeing a chance to earn easy money in the cyberworld.

But the bitcoin has also seen sudden falls. For example, the value of the bitcoin plunged to 2,850 yuan on Dec. 18 from a high of 8,000 yuan a month earlier.

Although the return rate is anything but stable, Lin Jia decided to try her luck. “I heard that one of my friends had won big in bitcoin investment,” says Lin. “And they're much cheaper right now. I plan to buy a few at one or two thousand yuan. I won’t complain if I lose. Won’t it be great if I can make a little money?”

Driven by the logic of buying during a dip, nearly 60 percent of the recent bitcoin trading took place in China, according to Bitcoin Charts.

Wild swings in value are not the only problem. Experts have raised their concerns. “On many occasions, the bitcoin is used as an arbitrage tool, rather than an alternative payment tool. Underlying problems may arise from technical risks and lack of scrutiny,” says Zhao Qingming, a professor of the school of economics and finance at China’s University of International Business and Economics.

The bitcoin is based on complicated cryptography but that doesn’t mean it is immune to a security breach. The accounts of Chinese investors have weak protection because many servers involved in Chinese bitcoin trading are located overseas, beyond the reach of regulation.

“The bitcoin doesn’t function as a currency, or benefit from credit support backed by government. Such speculation is not rare in China – it has happened before with Pu’er tea and mahogany furniture. The speculators may end up with large stocks of of worthless code,” warns Zhao.

People prepare for upcoming 'Chunyun'

People prepare for upcoming 'Chunyun'  Highlights of Beijing int'l luxury show

Highlights of Beijing int'l luxury show Record of Chinese expressions in 2013

Record of Chinese expressions in 2013 China's moon rover, lander photograph each other

China's moon rover, lander photograph each other 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start Spring City Kunming witnesses snowfall

Spring City Kunming witnesses snowfall Heritage of Jinghu, arts of strings

Heritage of Jinghu, arts of strings Weekly Sports Photos

Weekly Sports Photos PLA elite units unveiled

PLA elite units unveiled  China's stealth fighters hold drill over plateau

China's stealth fighters hold drill over plateau Chinese navy hospital ship's mission

Chinese navy hospital ship's mission  "Free lunch" program initiated in NW China

"Free lunch" program initiated in NW China  Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan DPRK's Kaesong Industrial Complex

DPRK's Kaesong Industrial Complex 'Jin' named the word of the year

'Jin' named the word of the year Day|Week|Month