Armed Police hold anti-terrorism drill in SE China's Xiamen

Armed Police hold anti-terrorism drill in SE China's Xiamen Harbin Int'l Ice and Snow Festival opens

Harbin Int'l Ice and Snow Festival opens 'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

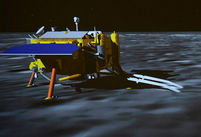

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each otherNEW YORK, Jan. 7 -- U.S. stocks rebounded Tuesday, with the S&P 500 closing with the first advance in 2014, as data showed the U.S. trade gap narrowed in November.

The Dow Jones Industrial Average rallied 105.84 points, or 0.64 percent, to 16,530.94. The S&P 500 gained 11.11 points, or 0.61 percent, to 1,837.88. The Nasdaq Composite Index jumped 39.50 points, or 0.96 percent, to 4,153.18.

The rally came after the S&P 500 and the Nasdaq declined in the first three trading sessions of the New Year on profit taking.

Wall Street seemed to renew confidence somewhat on encouraging data and positive comments from a pair of top Federal Reserve officials.

The Commerce Department said Tuesday U.S. international trade deficit in goods and services dropped to 34.3 billion U.S. dollars in November from the revised 39.3 billion dollars in October, as exports increased while imports declined.

"After eliminating the influence of prices, the trade deficit narrowed to a five-month low, indicating that trade will boost fourth quarter gross domestic product," said Jay Morelock, an economist at FTN Financial.

Before the U.S. stock market opened, Boson Fed President Eric Rosengren said long-term labor market scars, which resulted from a very slow recovery, led him to believe that "the Federal Reserve should remain highly accommodative and wind down our extraordinary programs only very gradually."

Echoing Rosengren's remarks, San Francisco Fed President John Williams said later in the day that the U.S. central bank is likely going to end its quantitative easing this year, while predicting that interest rates would maintain near zero for the " foreseeable future."

In corporate news, shares of JPMorgan Chase & Co., one of the biggest laggards of the Dow, fell 1.15 percent to 58.32 dollars a share, after the bank reportedly has agreed to pay 1.7 billion dollars for victims of Bernard Madoff's Ponzi scheme.

Investors are still awaiting a string of major events later this week, including the release of the Fed's minutes for its December policy meeting, U.S. nonfarm payroll report and the fourth-quarter corporate earnings.

On other markets, the U.S. dollar gained against most major currencies on the narrowed U.S. trade deficit data.

In late New York trading, the euro slipped to 1.3618 dollars from 1.3635 dollars of the previous session, the greenback bought 104.48 yen, higher than 104.28 yen of the previous session.

Oil prices rose as traders expected that extremely cold weather in the United States will boost fuel demand.

Light, sweet crude for February delivery edged up 24 cents to settle at 93.67 dollars a barrel on the New York Mercantile Exchange, while Brent crude for February delivery gained 62 cents to close at 107.35 dollars a barrel.

Gold futures on the COMEX division of the New York Mercantile Exchange closed below 1,230 dollars per ounce on a stronger dollar.

The most active gold contract for February delivery dropped 8.4 dollars, or 0.68 percent, to settle at 1,229.6 dollars per ounce.

Chinese Consulate General in S.F. burned for arson attack

Chinese Consulate General in S.F. burned for arson attack Roar of J-15 fighter is melody for operator on the Liaoning

Roar of J-15 fighter is melody for operator on the Liaoning A 90-year-old forester's four decades

A 90-year-old forester's four decades Most touching moments in 2013

Most touching moments in 2013 2013: Joys and sorrows of world politicians

2013: Joys and sorrows of world politicians Missile destroyer Zhengzhou commissioned to Chinese navy

Missile destroyer Zhengzhou commissioned to Chinese navy China is technically ready to explore Mars

China is technically ready to explore Mars Photo story: Life changed by mobile technology

Photo story: Life changed by mobile technology Bullet train attendants' Christmas Eve

Bullet train attendants' Christmas Eve Exploring the 'Maritime Silk Road'

Exploring the 'Maritime Silk Road' Armed Police hold anti-terrorism drill in SE China's Xiamen

Armed Police hold anti-terrorism drill in SE China's Xiamen Beautiful churches around the world

Beautiful churches around the world Panda cub Yuan Zai made public debut in Taiwan

Panda cub Yuan Zai made public debut in Taiwan  Stuffed polar bears displayed at Int'l Snow Sculpture Expo

Stuffed polar bears displayed at Int'l Snow Sculpture Expo Photographer captures frozen scenery in U.S.

Photographer captures frozen scenery in U.S.Day|Week|Month